Yield Curve Chart 2023

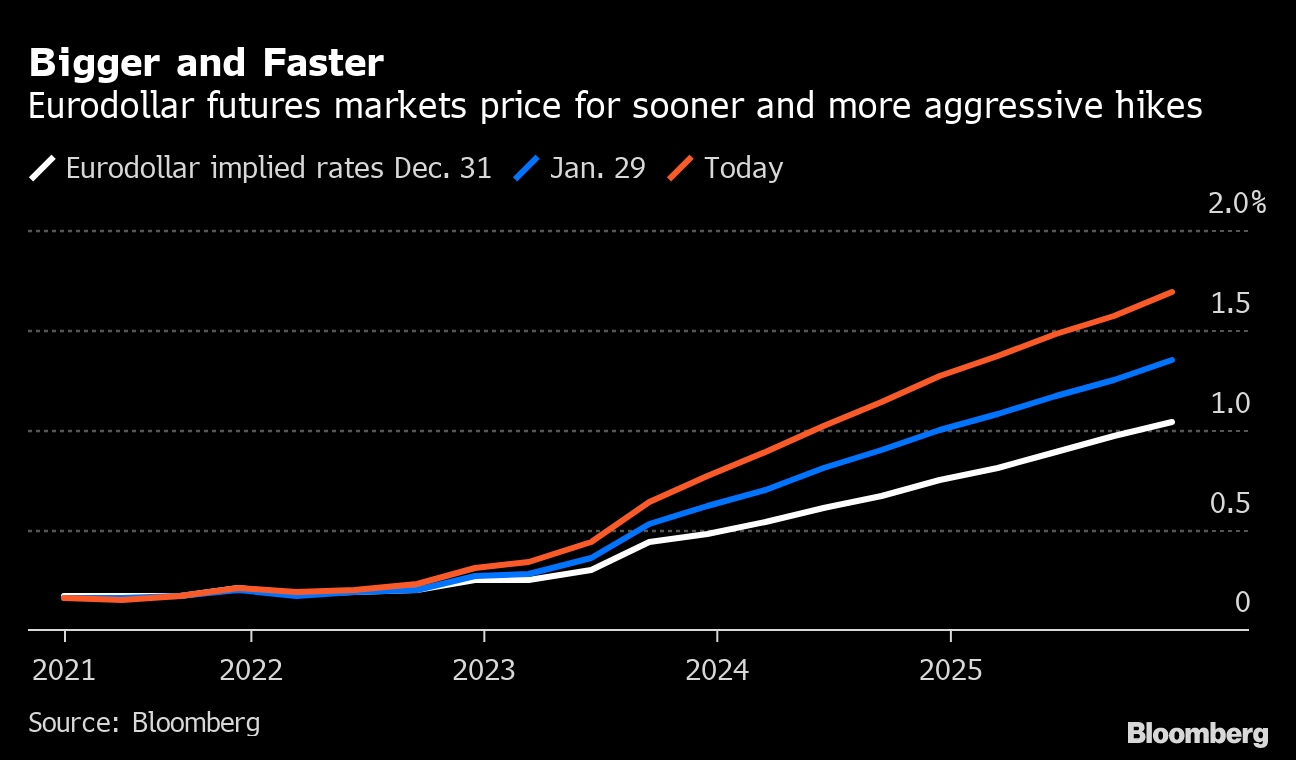

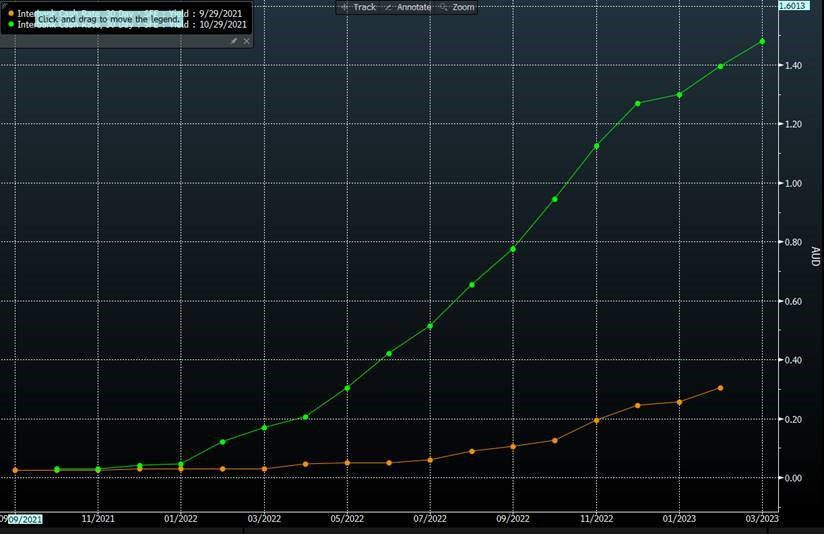

Yield Curve Chart 2023. In such a scenario short-term interest rates are higher than long-term rates, which is often considered to be a predictor of an economic recession. The yield curve, also called the term structure of interest rates, refers to the relationship between the remaining time-to-maturity of debt securities and the yield on those securities.

More specifically, the yield curve captures the perceived risks of bonds with various maturities to bond investors.

Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market.

Increase the "trail length" slider to see how the yield curve developed over the preceding days. More inversions signal a recession sooner rather than later. As bonds with longer maturities usually carry higher risk, such bonds have higher yields than do bonds with shorter maturities.

Rating: 100% based on 788 ratings. 5 user reviews.

David Holt

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Yield Curve Chart 2023"

Post a Comment