S Corp Vs Llc Chart

S Corp Vs Llc Chart. An S corp vs LLC chart shows the many similarities and differences between the two entities. The Difference Between an LLC and an S Corp.

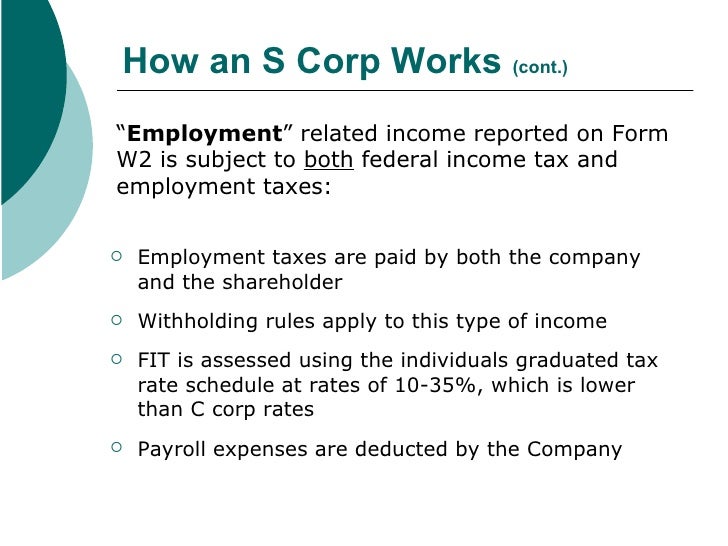

Understand the different tax treatments of each, what is required to qualify for an S Corporation, how to treat partners, the advantages and disadvantages of each and what else you will need to start each entity.

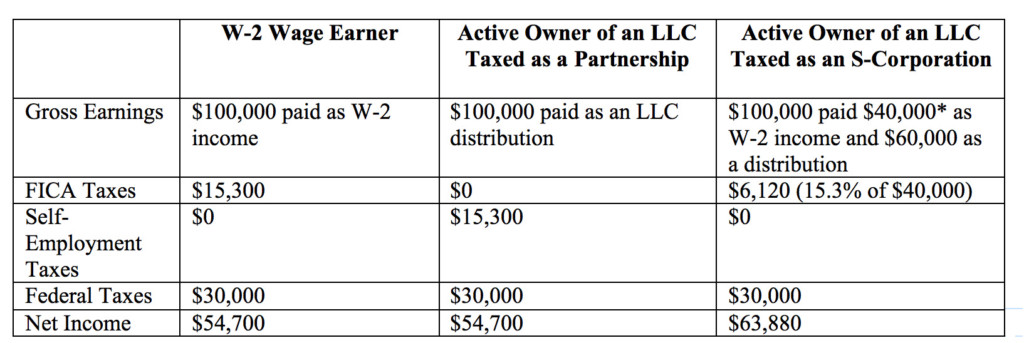

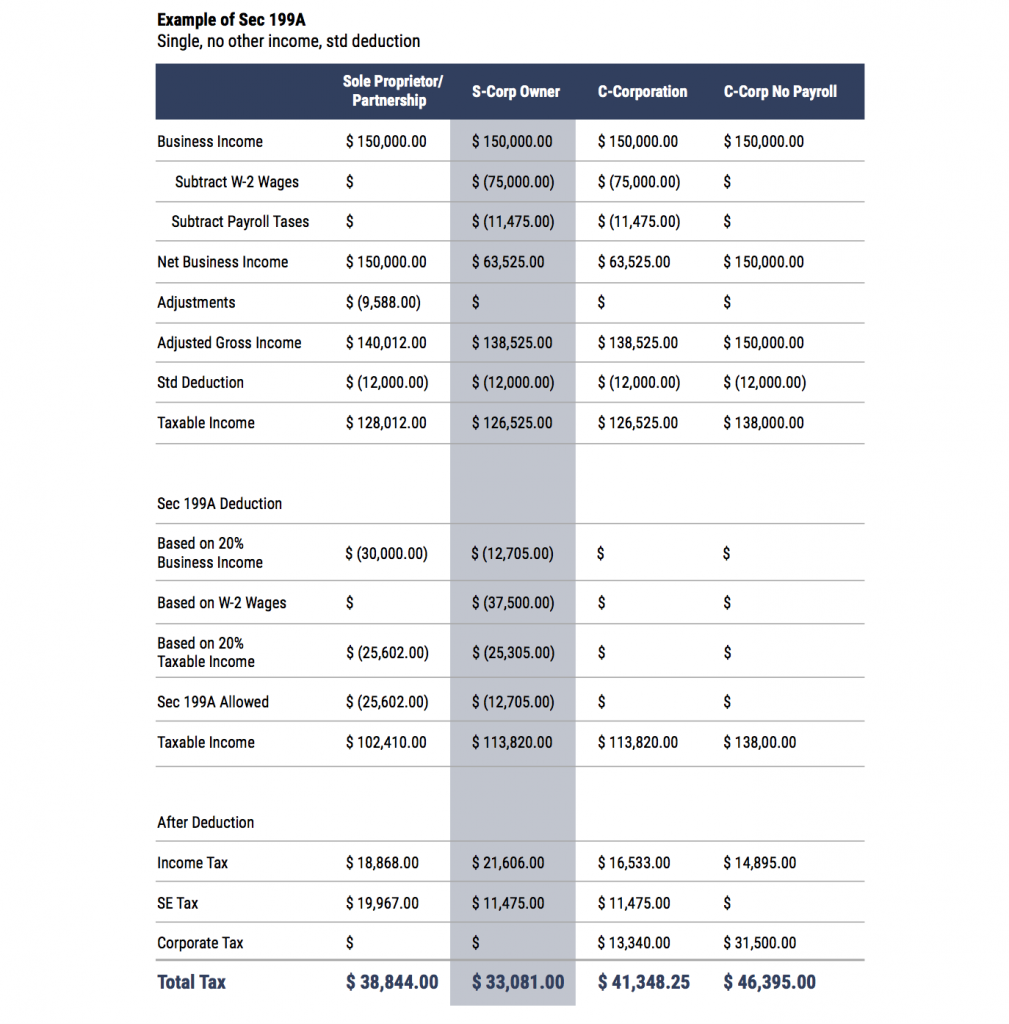

The main advantage of an S-corp over an LLC is its tax benefits.

While C-corps and S-corps share lots in common—such as limited liability. The S corp vs LLC comparison is pretty common since both structures have a pass-through taxation status. An S-Corp LLC is an LLC that has filed a tax election to be treated like an S-Corp for federal tax purposes.

Rating: 100% based on 788 ratings. 5 user reviews.

David Holt

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "S Corp Vs Llc Chart"

Post a Comment